Solutions for Municipalities

Municipalities have the daunting task of ensuring homeowners maintain the health and safety of their properties and keep them in good repair. When properties are vacant and are abandoned by their owners, that work becomes increasingly more difficult. In New York, mortgage servicers must maintain the exterior of a vacant/abandoned property throughout the foreclosure process. However, the New York foreclosure process can be very lengthy, and mortgage servicers often require approval from other parties prior to commencing certain repairs and maintenance.

We’re hopeful the information provided here will be useful to municipalities in understanding the differences between vacant properties and real zombie properties, mortgage servicers’ maintenance requirements and approval process, and why the mortgage process can seem drawn out. As you work with mortgage servicers, we hope you can also be a resource to concerned neighbors who likely expect the mortgage servicer and municipality to immediately address all issues at a vacant property.

VACANT PROPERTY

What is a Vacant Property?

A property not occupied by a homeowner, a relative of the homeowner, or a tenant lawfully in possession.

Evidence of lack of occupancy may include:

- Overgrown or dead vegetation

- Accumulation of newspapers, circulars, flyers, or mail

- Past due utility notices, disconnected utilities, or utilities not in use

- Accumulation of trash, refuse, or other debris

- Absence of window coverings, such as curtains, blinds, or shutters

- One or more boarded, missing, or broken windows

- Open to casual entry or trespass

- A building or structure that is or appears structurally unsound or has any other condition that presents a potential hazard or danger to the safety of persons

What is NOT a Vacant Property?

- An unoccupied property undergoing construction, renovation, or rehabilitation that is proceeding diligently to completion.

- A property occupied on a seasonal basis that is otherwise secure.

- A property that is secure but is the subject of a probate action, quiet title action, or other ownership dispute.

- A property that is damaged by a natural disaster that one or more owner intends repair and reoccupy.

- A property occupied by the homeowner, a relative of the homeowner, or a tenant lawfully in possession.

ZOMBIE PROPERTY

What is a Vacant/Abandoned Mortgaged Property?

Per the New York State Real Property Actions & Proceedings Law Section 1309, a vacant and abandoned residential property is defined as:

1). A property encumbered by a mortgage for which three (3) consecutive inspections are conducted by the mortgage servicer (25 to 35 days apart at different times of the day) during which:

- no occupant was present and there was no evidence of occupancy at the property to indicate any persons are residing there, and;

- the property is not being maintained in a manner consistent with the standards set forth in New York Property Maintenance Code Chapter 3 sections 301, 302 (excluding 302.2, 302.6, 302.8), 304.1, 304.3, 304.7, 304.10, 304.12, 304.13, 304.15, 304.16, 307.1, and 308.1

2). A property formally determined to be vacant by a court or other appropriate state or local governmental entity, after due notice to the homeowner at the property address and any other known addresses.

3). A property for which each homeowner has separately issued a sworn written statement expressing their intent to vacate and abandon the property, after receipt of which a mortgage servicer inspects the property, which shows no evidence of occupancy to indicate that any persons are residing there.

What is a “Zombie” Property?

A vacant/abandoned mortgaged property for which the mortgage servicer does not timely initiate foreclosure proceedings when a homeowner is not engaged in or does not qualify for available loss mitigation assistance options.

A zombie property is a vacant and abandoned property where the mortgage servicer does not timely proceed with active foreclosure proceedings in good faith.

What is NOT a “Zombie” Property?

A vacant/abandoned property for which the mortgage servicer is timely initiating or proceeding with foreclosure proceedings in good faith, despite any holds or delays as a result of loss mitigation assistance reviews, bankruptcy filings, or court holds/delays

A vacant/abandoned property for which the mortgage servicer completes a foreclosure or otherwise discharges its lien on the property

Mortgage Foreclosure

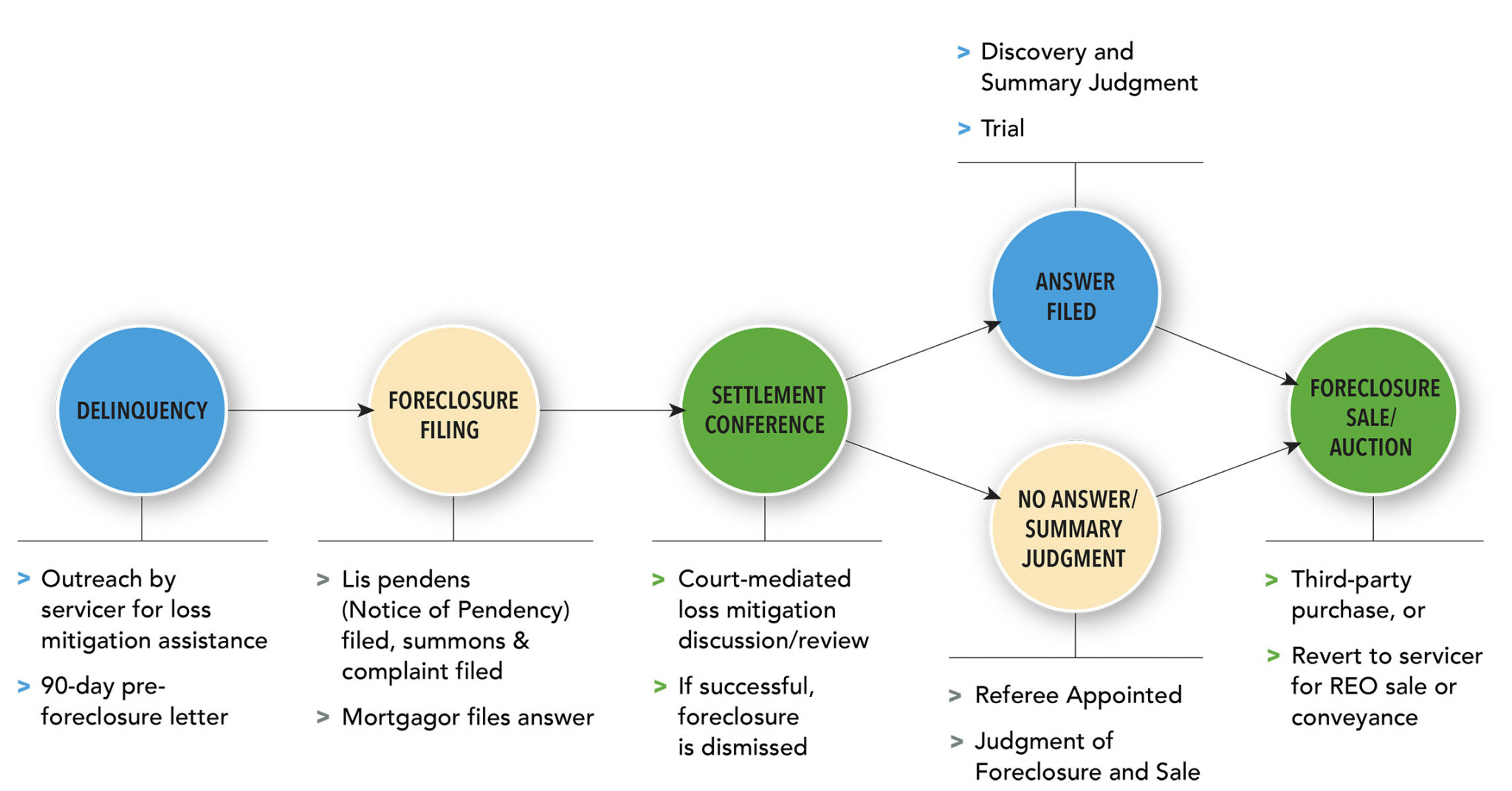

The foreclosure process in New York can be lengthy and complicated, but it has been designed to afford homeowners with protections and many opportunities to work with their mortgage servicer to avoid losing their home.

When mortgage payments are missed, a homeowner is considered in default of their mortgage loan and are at risk of foreclosure. The mortgage servicer will reach out by phone and letter to discuss any financial hardships and review available assistance options, such as a temporary forbearance (an agreement to pause and then repay monthly payments), a repayment plan, or a loan modification (an adjustment of the terms of the mortgage loan). If the homeowner does not qualify for these options or does not wish to keep their home, the mortgage servicer can review for a short sale, which is when the homeowner is able to sell the property for less than what is owed (depending on the value of the property), or for a deed in lieu of foreclosure, in which the homeowner signs an agreement to give the property to the mortgage servicer rather than go through the foreclosure process. These are all called loss mitigation options. It is very important for homeowners who miss or are unable to make their monthly mortgage payments to contact their mortgage servicer to discuss all available options.

If a mortgage servicer is unable to contact the homeowner or if the homeowner does not request or qualify for a loss mitigation option and the mortgage loan remains in default, the mortgage servicer may file a foreclosure action, and the summons and complaint will be served upon the homeowner. The homeowner may file an answer with the court.

After the foreclosure process begins, the court will mandate a settlement conference, during which a court mediator will meet with both the homeowner and mortgage servicer to ensure all available loss mitigation options are reviewed. If a loss mitigation option is able to be approved and completed, the foreclosure action will be dismissed. Otherwise, the foreclosure action will proceed.

If the foreclosure action continues and the homeowner filed an answer, the case will go through the litigation process. Either through litigation, or if the mortgage servicer requests summary judgment, the court will review the facts of the case presented by both parties and determine the outcome of the foreclosure action.

If the homeowner does not file an answer, the court grants the mortgage servicer’s request for summary judgment, or the mortgage servicer prevails at trial, a referee will be appointed to determine the full amount owed to the mortgage servicer. Thereafter, the court will enter an order for judgment of foreclosure and sale of the mortgaged property. The sale date will then be set and published in the newspaper and may be posted publicly.

At the foreclosure sale or auction, if a third-party is the highest bidder, they will become the owner of the property. If no one bids higher than the mortgage servicer, the mortgage servicer will complete a REO (real estate owned) sale of the property to an interested purchaser; however, if there is an investor or insurer with an interest in the property, the mortgage servicer may be required to convey, or transfer, ownership of the property to that investor or insurer.

Mortgage Servicer Maintenance Requirements and Process

Requirements

Mortgage servicers often service mortgage loans that are owned or insured by other entities, such as the government-sponsored enterprises Fannie Mae and Freddie Mac, or government agencies such as FHA, USDA, and VA. The State of New York Mortgage Agency (“SONYMA”) also owns many mortgage loans serviced across New York. Mortgage servicers are required to follow these investor/insurer guidelines that specify what property maintenance can or should be completed on vacant/abandoned mortgaged properties when the mortgage loan is in default or undergoing foreclosure proceedings.

If a property is deemed to be vacant and abandoned, the mortgage servicer must ensure the property remains secure and inaccessible to unauthorized entry, maintain the lawn and yard from overgrowth, and repair any immediate health or safety conditions that could cause further deterioration to the property.

Investor and Insurer Servicing Requirements

- Fannie Mae Servicing Guide

- Freddie Mac Servicing Guide

- FHA Single Family Housing Policy Handbook

- USDA Single Family Housing Handbook

- VA Servicer Handbook

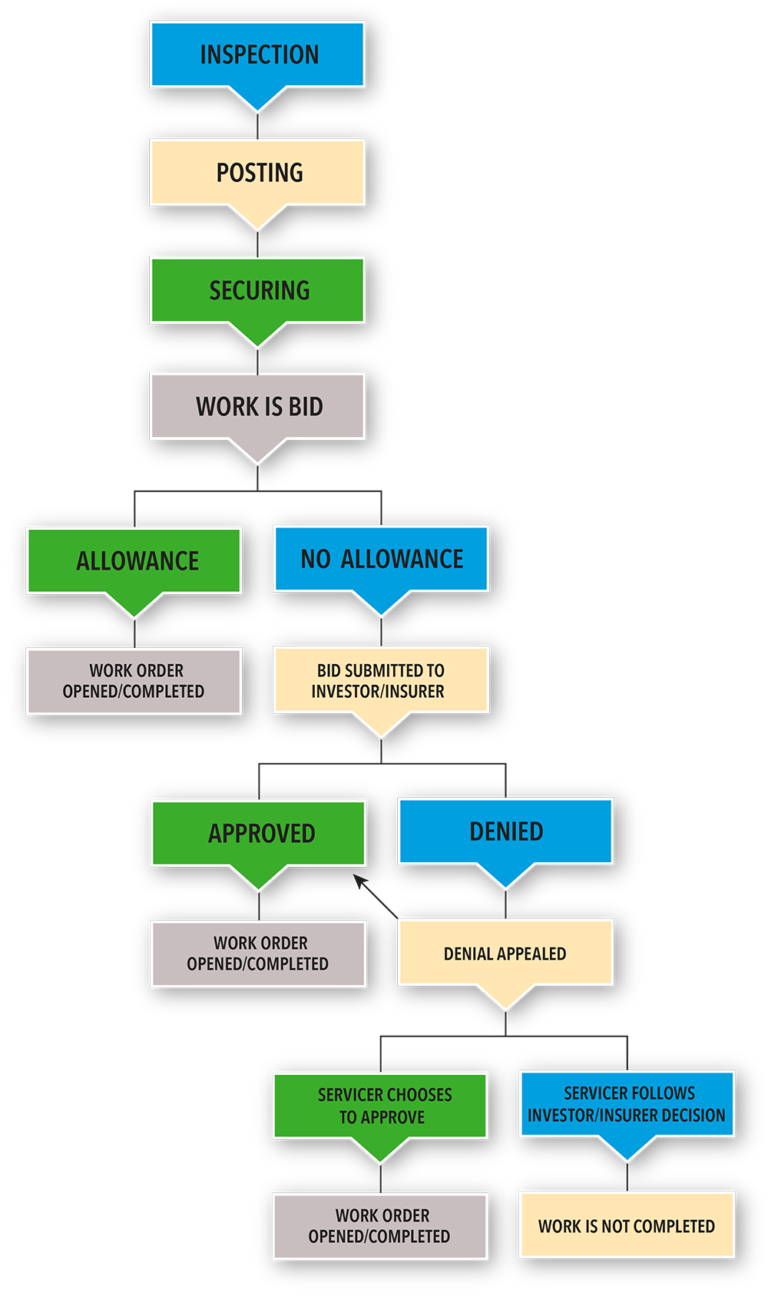

Most investors and insurers provide set allowances for work that may be needed on a vacant property. If an allowance is not provided or work cannot be completed for the allowance, the mortgage servicer must seek approval from the investor/insurer prior to commencing that maintenance or repair. The following process can delay the start or completion of maintenance or repair work if approval needs to obtained from the investor/insurer.

New York State Zombie Property Maintenance Requirements

In addition to specific investor and insurer maintenance requirements, New York State passed legislation commonly known as the 2016 Zombie Property Law which sets forth requirements for mortgage servicers to inspect delinquent mortgage loan properties and, when confirmed to be vacant, secure and maintain such properties to prevent the property from deteriorating and causing neighborhood blight.

If you have a concerns with a vacant/abandoned mortgaged property, you may report a zombie property that is not being properly maintained by the mortgage servicer to the New York State Department of Financial Services (“NYSDFS”) by calling NYSDFS at 800-342-3736 or submitting a complaint via the NYSDFS Complaint Portal.

Municipal Tax Foreclosure

Note: with a onset of the COVID-19 the Federal Government and NYS have passed legislation putting moratoria on foreclosures (including tax foreclosures and bank foreclosures). Due to these moratoria, neither Monroe County nor the City of Rochester are expected to complete foreclosure actions or conduct foreclosure sales before 2022.

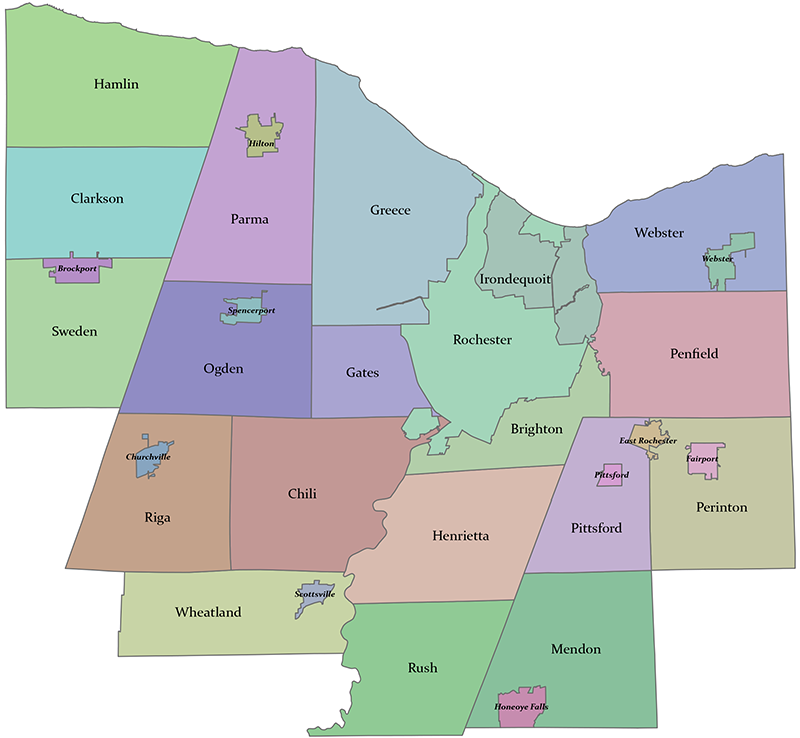

Monroe County

Annually (typically in October) Monroe County holds a foreclosure sale of tax delinquent properties that have progressed through a 28-month foreclosure process. In mid-August, a list of properties with unpaid taxes and eligible for foreclosure is published in local newspapers (Rochester Business Journal and Daily Record) as well as on the Monroe County website. Anytime during the 28-month Foreclosure Process, if certain requirements are met, a payment plan can be negotiated by the owner to keep the property out of foreclosure. To negotiate a tax agreement or pay of a lien, an owner should contact the Monroe County Treasury Department. Other factors that allow removal of a property from the foreclosure process include: full redemption of the tax lien;

property owner has entered into bankruptcy; removal has been ordered by a Court; Legislative approval has been obtained based on the request of the Director of Finance.

The Director of Finance may request Legislative approval to remove a property from the Foreclosure process based on the following: a person with an interest in the property has raised a question as to the validity of the tax lien encumbering that property; the tax district has instituted other proceedings to enforce the tax lien by other statutory methods; an eligible owner of the property has entered into a repayment agreement; the tax lien encumbers a property which is either a known or suspected hazardous waste site.

Commencing in May of Year 1 and usually ending in October of year 3

| Month | Year No.1 | Year No.2 | Year No.3 |

| January | Send out tax bills | ||

| February | Payments in full are due on or before 2/10 or installment payments can commence | MC sends out 7th delinquency notice | |

| March | |||

| April | If payments are in installments- last installment payment is due | ||

| May | The Foreclosure Process starts MC sends out a statutorily required 1st delinquency notice | ||

| June | MC sends 5th notice | ||

| July | MC sends out 2nd delinquency notice | Either June or July (depending the sale date) Outside attorney will send a delinquency notice | |

| August | 8/15 List of properties with unpaid taxes must be published 8/20 unpaid taxes are declared delinquent | 8/15 List of properties with unpaid taxes must be published for the 2nd time Since taxes have been delinquent for One year, the properties are eligible for foreclosure | |

| September | MC sends out 3rd delinquency notice | MC sends out 6th delinquency notice | Schedule foreclosure sale |

| October | |||

| November | Foreclosure sale | ||

| December | MC sends out 4th delinquency notice |

City of Rochester

Annually (typically in November) the City of Rochester holds “In Rem” Tax Foreclosure auction for properties where the respective owners have delinquent taxes. A tax lien becomes delinquent when taxes due are unpaid for more than one year and foreclosure auctions occur approximately 16 months after a tax lien becomes delinquent. A list of properties that may be available at the tax foreclosure auction is published in a local newspaper approximately a month prior to the auction. This list changes as existing owners are able to pay their delinquent balances up until the time their property is auctioned. Owners with delinquent property taxes may also be eligible to enter into a Tax Agreement with the City to repay the taxes through an agreed upon payment plan and thereby avoid foreclosure.

Individuals who are interested in bidding on a property at the tax foreclosure auction must register for the auction and must have adequate funds for a deposit the day of the auction with the remaining balance due shortly after. Current owners with delinquent taxes may not bid on their own properties and may not have others bid on their behalf. If there are no successful bidders through the auction process, the City takes title to the property. More information can be found at https://www.cityofrochester.gov/TaxForeclosureAuctions/

Foreclosure action, files list with properties more than 13 months delinquent on their City property taxes. The typical subsequent foreclosure timeline follows:

| February | Treasury compiles list of properties with year-old delinquent taxes |

| March | Treasury sends warning letter to property owners |

| April | Law Department commences foreclosure action, files list with County Clerk’s office |

| April/May | Public notice of foreclosure published in newspaper |

| August | Notification to property owners and lienholders |

| September | Lienholders may redeem or file a Notice of Interest |

| October | Treasury sends final foreclosure letter City obtains judgment of Foreclosure and Sale |

| October-November | Four consecutive legal notices for foreclosure sale published in newspaper |

| November | Tax foreclosure auction – opening bid is amount of unpaid taxes; if City is the only bidder, City takes title |